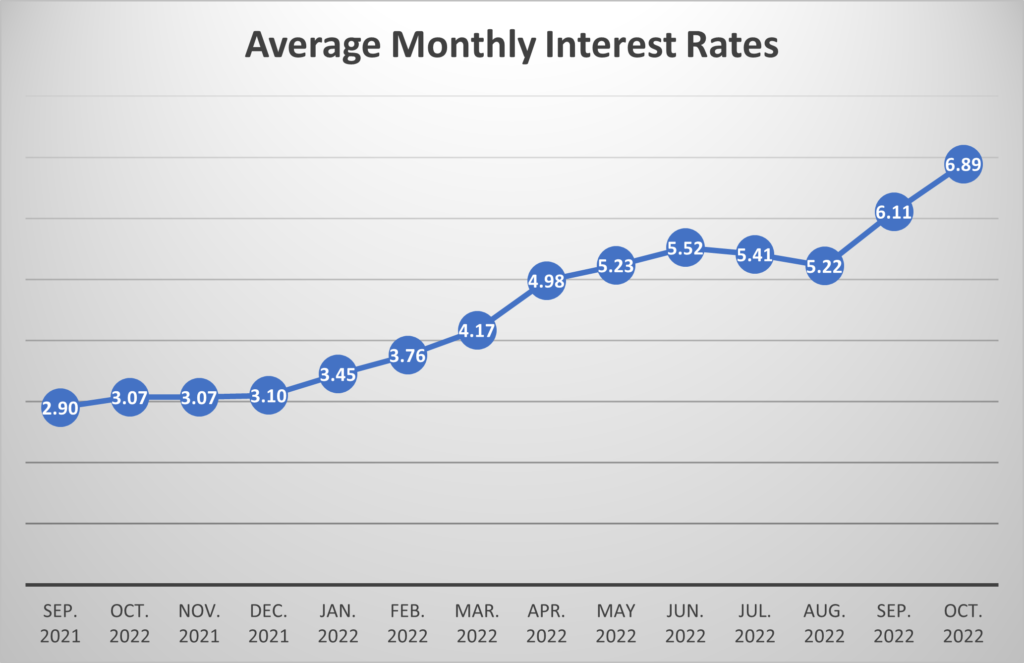

We are in a strange time in the real estate market. As I’m writing this post the average national 30-year fixed interest rate sits at 6.92% according to the Federal Reserve. Interest rates have climbed 137.6% since September 2021, while average home sale prices in Snohomish have increased by 9.88% according to the data from the NWMLS.

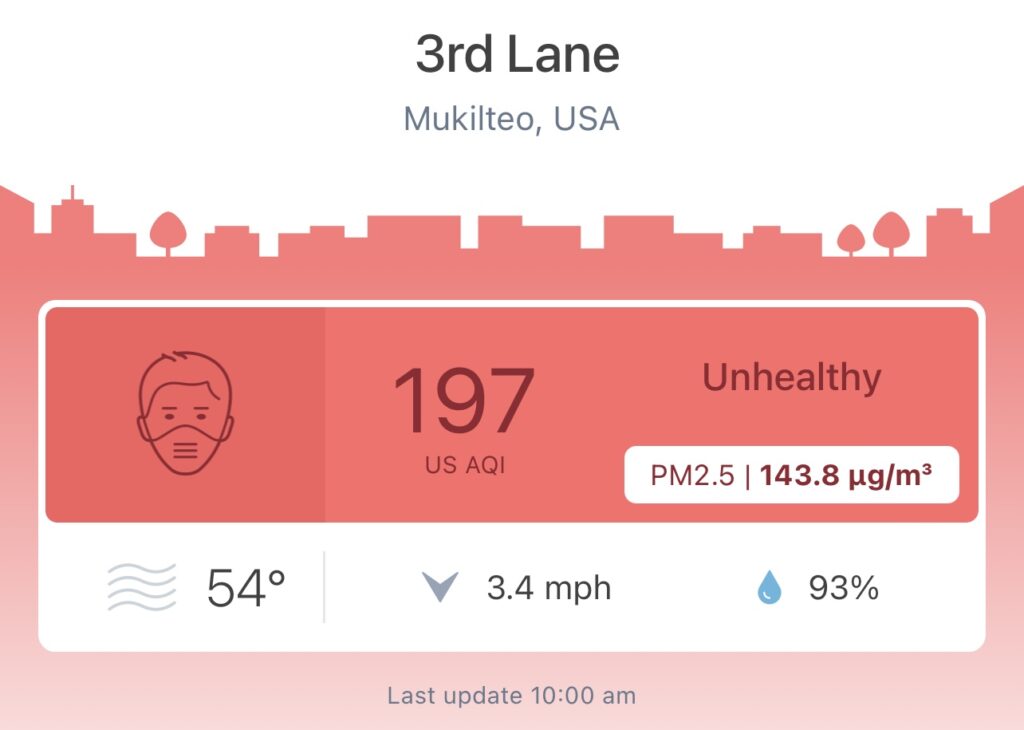

Today’s rates, like the wildfire smoke filling the air, may seem stifling but there are ways to combat our current situation and perhaps even make it work in your favor… the interest situation that is, we need rain to get our air quality back. There are a number of loan options available right now that are designed to help combat the ever increasing rates. I am happy to connect you with one of the professional mortgage brokers I worth with to discuss those.

There are a few other options available to buyers right now as well. As the always the best option is simply paying cash but most of us don’t have enough cash laying around to buy a house, especially with record high prices we continue to see. This is where Home Partners of America comes in. Home Partners of America is a rent to own program that will purchase the home for you in cash and then allow you to rent it from them until you are ready to purchase. You have 5 years to execute your purchase option. During that period, you can activate your option at any time.

So far we’ve seen home prices stay high but as of September the NWMLS reports the average home sale in Snohomish County is closing at 95.7% of listing. Back in March, the average closed home sale was at 111.3% of asking. This means savvy buyers, working with skilled agents, are finally getting some breathing room. With average days on market increasing from 7 to 26 days, sellers are also more willing to give concessions, buy down interest rates, pay closing costs, and bend over backward for buyers.

Now is an excellent time as a buyer to develop your winning strategy and take advantage of the market while others are running scared. Whether is rent to own, a specialized loan product, buying now and refinancing when rates drop, paying cash, or negotiating a price that makes interest rates irrelevant, build you plan, and execute while others are on the sideline.